HSBC Life Protect Advantage

Good news for Singaporeans. There is new competition within the insurance sector as HSBC rebrands its Singapore insurance business and launches a new whole life insurance product: HSBC Life Protect Advantage. This is part of HSBC’s plan to help Singaporeans enhance the protection element of our financial portfolio.

To help our readers make better financial decisions, we are going to dissect the HSBC Life Protect Advantage and find out whether it is a good plan for Singaporeans to consider.

HSBC Whole Life Insurance: How It Works

The Life Protect Advantage is one of the simplest participating whole life plans in the market that is designed to help you keep your promises to your family without the complexity. It offers death and terminal illness coverage up to age 99 with Total and Permanent Disability (TPD) coverage up to age 70.

You can choose from a flexible premium term ranging from 10 to 25 years in intervals of 5, i.e. 10, 15, 20, 25.

5 Reasons Why You Should Consider HSBC Life Protect Advantage

Now that we have gotten the basic of how it works out of the way, it is time to analyse the pros and cons of the plan. Here are 5 reasons why we think you should consider this whole life insurance policy.

-

HSBC Life Protect Advantage Ensures Your Insurability

Everyone’s need for protection evolves as we journey through different life stages. As such, the type of insurance plan we need at different stages in life differs. One issue with taking on such a mentality is the problem of insurability.

Let’s say you only start thinking about buying insurance after you are married. This is due to the evolving responsibility on you as a spouse and maybe even a parent. But can you still be sure that your health will be in good condition for you to be fully covered? What if you are excluded from certain coverage due to a pre-existing condition?

One of the advantages of HSBC Life Protect Advantage is that it offers guaranteed insurability. Once you own HSBC Life Protect Advantage, you can buy any other insurance plans from HSBC insurance without having to undergo any medical underwriting. This means that even if you develop a pre-existing condition, you will still be covered like everyone else. This gives you a lot of flexibility in buying protection plans only when you need it.

-

Flexibility To Enhance Coverage At Different Life Stages

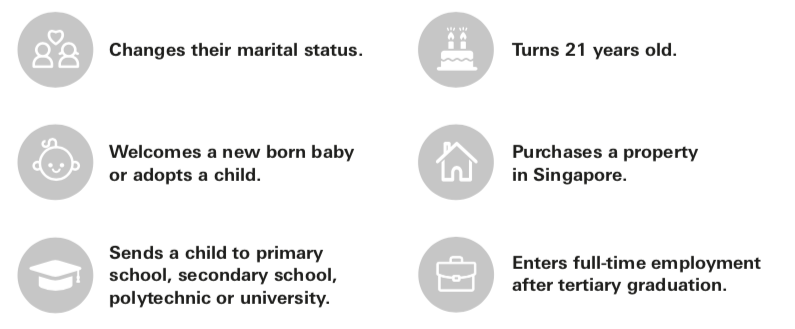

HSBC Life Protect Advantage also gives the insured life the flexibility of enhancing your coverage during important life stages. These 6 life stages are:

- Coming of age, i.e. turning 21 years old

- Graduated and entering the work force

- Marriage

- Welcome a new born or adopt a child

- Buy your first property

- When your child enters primary, secondary or tertiary institutes

-

Life Multiplier Feature That Lets You Extend Your Coverage

HSBC Life Protect Advantage comes with two key life multiplier features that benefit you as a policyholder: Life Advantage Multiplier and Life Extender Multiplier.

Life Advantage Multiplier lets you boost your life coverage by up to 5x until you are age 70 at a small increase in premium. Life Extender Multiplier gives you the option of extending your coverage beyond age 70, all the way up to age 99. You have the option of opting into Life Extender Multiplier at every 5th policy anniversary or whenever your life stage changes before age 60 (refer to point 2 for life stages).

-

Comprehensive critical illness coverage

Given the increasing longevity of Singaporeans, HSBC acknowledges that the risk of critical illness is one that gets us worried. Thus, HSBC aims to help Singaporeans manage the risk of critical illness with comprehensive critical illness coverage.

While other life insurance plans do also come with the option of critical illness coverage, none comes as close to HSBC Life Protect Advantage in terms of protection. If you haven’t already heard, HSBC Life Protect Advantage covers 144 different critical illness and special conditions, making it the most comprehensive critical illness coverage in the market.

-

Got A Pre-Existing Condition? Don’t Worry, HSBC Life Protect Advantage Will Still Protect You

For those with a pre-existing condition, it is difficult (or near impossible) to find an insurer who is willing to cover you for your pre-existing condition. But HSBC isn’t one of them. Under the HSBC Life Protect Advantage, you can be accepted for pre-existing benign conditions such as breast, prostate or ovarian cyst and receive a 20% payout if they progress into cancer.

What To Look Out For If You Are Considering HSBC Life Protect Advantage?

While there are many benefits of protecting your life through HSBC Life Protect Advantage, it also has its limitations. Here are some things you need to look out against if you are considering HSBC Life Protect Advantage.

-

High Minimum Sum Assured

According to HSBC, the minimum sum assured on HSBC Life Protect Advantage is $50,000. The minimum sum assured amount is rather high, especially if you consider the Life Advantage Multiplier feature where you can boost your coverage by 5x.

-

Limited Flexibility On Unlocking The Cash Value

Although HSBC Life Protect Advantage comes with a cash value, you have limited flexibility on how you want to unlock the cash value. The only way to cash out is to take a policy loan or fully surrender the plan. Unlike other insurers, HSBC does not offer a monthly income option or a partial surrender option.

-

Uncertainty On Premiums To Be Paid After Age 70 For The Life Extender Multiplier Benefit

The Life Extender Multiplier is a salient feature of the HSBC Life Protect Advantage plan. However, it comes at a cost that is still uncertain to policyholders. While it can be a good feature to have, the lack of clarity on the cost portion makes it difficult to evaluate whether it is worth getting.

Start Planning For Your Own Protection Today For Your Loved Ones

Here is what you can do next.

Get your quotation for HSBC Life Protect Advantage and other insurers here!

Our partnered financial planners will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All comparisons done are solely based on your individual needs.

Get Your Whole Life Insurance Quotes

Comments