2 Best Early Critical Illness Plan: A Plain Vanilla Solution

In Singapore, there is a cliché saying, “Better to die than to fall sick”. While it is cliché, there is probably some truth in it. Let’s be honest. We have all read enough stories of expensive medical bills leading to financial insecurity whenever one gets diagnosed with critical illness or early critical illness (e.g. cancer).

Fact: More Than Half Of Singaporeans Do Not Have Critical Illness Protection

Yet, despite knowing how scary medical bills can be if we fall sick, 57% of Singaporeans still do not have any form of critical illness protection. This means that we will be left to grapple with not just the emotional stress of coming to terms with critical illness, we will also have to deal with the financial burden that comes with it. Even for those with critical illness protection, 63% of us do not feel confident that it is enough to ensure our financial security.

Critical Illness Can Strike Anytime

The truth about critical illness is that it cannot be taken for granted. Critical illness can happen to anyone and at any time. Statistics show that there are 36 people being diagnosed with cancer every day. The number of cancer cases has jumped by 17% since 2010 with 1 out of every 4 to 5 people developing cancer in their lifetime. Another top critical illness is stroke, which affects 1 in every 6 people. There is, however, a silver lining in the cloud.

Early Detection And Treatment Is Key To Recovery

With today’s medical advancements, early detection of critical illness is not only possible, but it also gives us a much better chance of recovery. In order to get the best treatment early and not having to worry about the loss of income, mounting debt or our children’s education fees, it is important to ensure you are financially protected. One way to get yourself the right financial protection is through an Early Critical Illness plan.

What Is An Early Critical Illness Plan?

Here’s how an Early Critical Illness plan works. Upon diagnosis of an early or intermediate stage Critical Illness, the Early Critical Illness plan will make a lump sum payout to you. This will provide you with the money for timely treatment of your diagnosed Critical Illness.

Early Critical Illness Plan vs Critical Illness Plan

Some of you might have heard of Critical Illness plan, but don’t be confused between an Early Critical Illness plan and a typical Critical Illness plan.

For Critical Illness plan, a payout is only made when you are in the late stages of your Critical Illness. At that stage, it is much more expensive to treat your Critical Illness and you have a lower chance of treating it at the root.

For Early Critical Illness plan, a payout is made as early as the first detection of your Critical Illness or the requirement to do certain medical procedures such as open heart or brain surgery. This gives you not only the money you need for treatment, it also gives you ample time to seek the right treatment. Early access to the right treatment greatly increases your chance of treating your Critical Illness and snipping the problem at the bud.

Which Early Critical Illness Plan Should I Consider?

Now that you are convinced (hopefully) of getting an Early Critical Illness plan, the next step is to find the most suitable Early Critical Illness plan in the market. Based on our research, there are two Early Critical Illness plans you can consider: Tokio Marine EarlyCover and Aviva My Early Critical Illness plan.

Both plans are single lump sum Early Stage Critical Illness plans. Upon diagnosis of Critical Illness, you can make claims. You will then receive a lump sum payout and the plan expires. This is unlike a multi-pay plan where you can make multiple claims should your Critical Illness relapse or you get diagnosed with another Critical Illness.

Read The 3 Best Recurrent Multi Payout Critical Illness Plan in Singapore

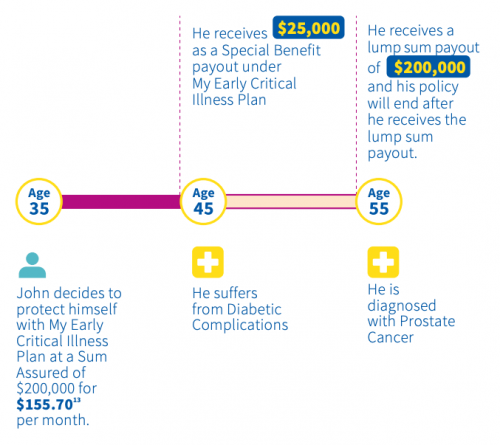

Source: Aviva

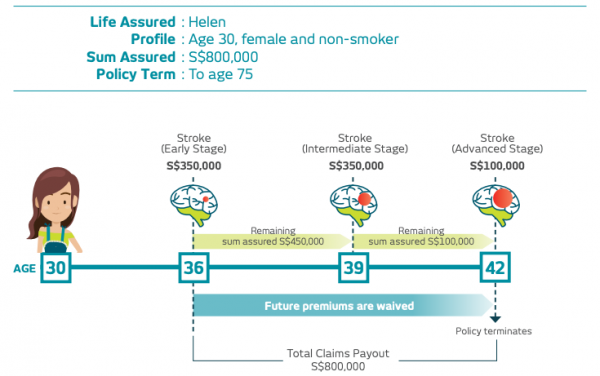

Source: Tokio Marine

2 Best Early Critical Illness Plans Tokio Marine EarlyCover vs Aviva My Early Critical Illness: What Are The Key Differences?

The only similarity between Tokio Marine EarlyCover and Aviva My Early Critical Illness plan stops at them both being lump sum Critical Illness plans. Here’s a look at the key differences between Tokio Marine EarlyCover and Aviva My Early Critical Illness and which plan gets an edge over the other.

1. Types Of Critical Illness Covered

When you purchase a Critical Illness plan, it is important that you have a clear idea which are the Critical Illnesses covered under the plan. If your Critical Illness does not fall under the list, you will not be able to make a claim, even if you think your condition should be considered a Critical Illness.

Between Tokio Marine EarlyCover and Aviva My Early Critical Illness, they cover a different number of conditions. Aviva My Early Critical Illness allows you to claim against 136 conditions whereas Tokio Marine EarlyCover only allows you to claim for 119 conditions.

But it is not just about the number of conditions covered. More importantly, Tokio Marine EarlyCover does not provide early stage coverage for some rare Critical Illnesses like Apallic Syndrome and Poliomyelitis. But Aviva My Early Critical Illness does.

Edge: Aviva My Early Critical Illness

2. Coverage Term

One other key difference between Tokio Marine EarlyCover and Aviva My Early Critical Illness is the coverage term.

Tokio Marine EarlyCover gives you less choice for coverage term compared to Aviva My Early Critical Illness. With Tokio Marine EarlyCover, you can only choose coverage up to age 70, 75 and 85.

Aviva My Early Critical Illness gives you a much more flexible choice with coverage term from 5 years till age 99. In addition, the maximum age you can be insured till is 99, rather than 85 for Tokio Marine EarlyCover.

Edge: Aviva My Early Critical Illness

3. Premium

Besides coverage term and conditions covered, premium is also an important aspect for comparison. While Aviva My Early Critical Illness might provide more coverage, it might come at a higher cost.

Based on our research, for the same coverage term, Aviva My Early Critical Illness does come at a higher premium than Tokio Marine EarlyCover across most age categories.

On a side note, both Aviva MyEarly Critical Illness and Tokio Marine Early Cover are eligible to be added as a rider to the term insurance plan. The coverage term for TM Early Cover is as flexible as the basic plan in terms of adjusting the coverage term, anywhere from 11 years to age 85. Also by adding TM Early Cover as a rider, policy holder may enjoy some premium discount.

Edge: Tokio Marine Early Cover

Compare Early Critical Illness Premium

Edge:

If you want more coverage – Aviva My Early Critical Illness

If you want a cheaper plan – Tokio Marine EarlyCover

If you want stand alone coverage period flexibility – Aviva My Early Critical Illness

Don’t Regret Not Having An Early Critical Illness Plan

Get both insurers quotes for the most competitive plan here !

A Licensed financial planners will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All comparisons done are solely based on your individual needs.

Get your Early Stage Critical Illness Insurance Quotes Here.

Comments